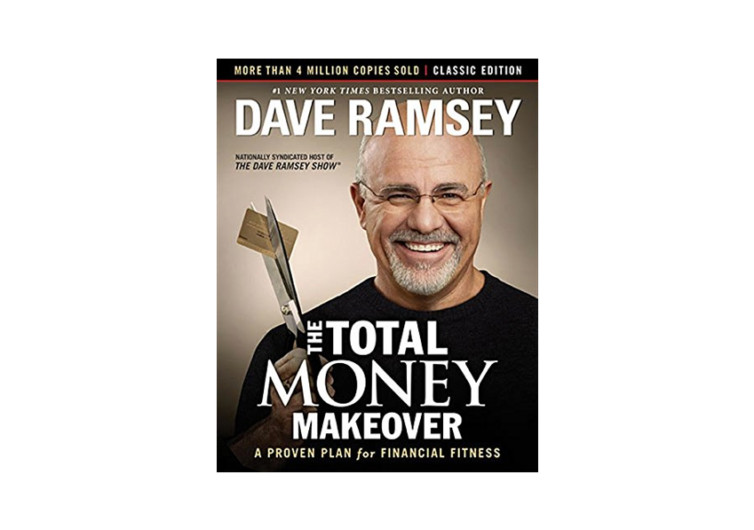

The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

Financial stability is one of the primary goals, if not the top, that everyone desires to achieve in this lifetime. Although the concept is quite easy to grasp, the ways in achieving it can be tricky. The Total Money Makeover: A Classic Edition is a great read for those who have zero to moderate level of knowledge about money saving, debt management, and retirement funds.

Sure, there are several blogs, vlogs, news articles, podcasts, and books about money management. And sometimes this can get too overwhelming because there are principles that appear contrasting or ambiguous. Finding a book written by an authority in the money management will greatly help.

The Total Money Makeover is written by Dave Ramsey III, America’s trusted voice in financial matters. He offers practical and fool-proof ways to solve money problems like debt. For instance, despite criticisms, he strongly advocates for the debt snow ball method, i.e., paying the smallest debt first. The said method turns out to be effective, as supported by academic research.

The Total Money Makeover book, besides being authored by a credible author, also offers the benefit of specialized knowledge. It particularly touches the topic of transforming your bad financial situation into good status. It particularly discusses debt management, emergency funding, and retirement planning.

Additionally, it tackles 10 damaging myths about money like loaning money to friends is a natural occurrence, one that people should willingly welcome. Ramsey cited practical reasons why this debt arrangement often does more harm than good to the lender. This thought is, indeed, an eye-opener. It may be slightly brutal but its implication is true and practical.

So to speak the book offers straightforward, practical, and effective advice. It features real-life testimonials as well. However, if you’re a reader whose goal is to invest or identify income streams, then this read may not be suitable for you. Likewise, if you’re well-versed with the basics of financial management, you may need alternative reading material, preferably with higher investment or economics complexities.