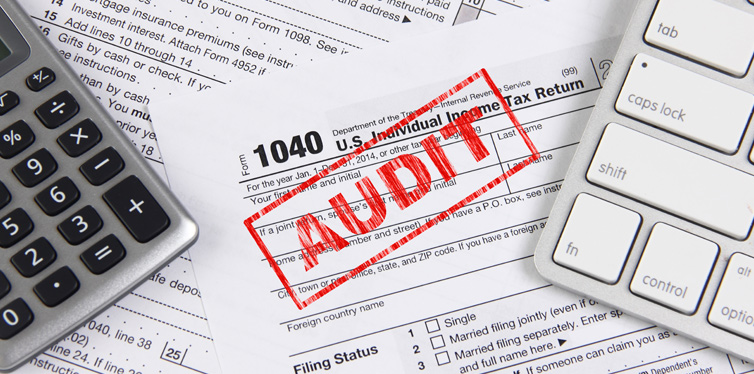

Avoid Getting Audited by the IRS

There’s nothing as sure as death and taxes. For the smooth running of society and for the economy, everyone needs to pay their share. Even so, there are still some around who think they have enough smarts to dodge paying the taxman. It has always been so, which is why the IRS have ways to check and find out who isn’t paying all they should. If you fear a tax audit, it may help you to know how the auditing system works.

What Is A Tax Audit

A tax audit is when the IRS wants to review your tax report more thoroughly to ensure the taxes and expenses you report are correct. When anything you submitted on your report appears out of the norm it can trigger a closer investigation. There are three major types of IRS audits postal audit, workplace audit and field audit.

1. Understand The Selection Process

While the method might appear quite arbitrary, in reality, to identify audits, the IRS uses Discriminate Income Feature (DIF). It’s a sophisticated computer program that compares declared expenses against others in the same tax stream.

This doesn’t mean you won’t get the exemptions you’re entitled to. You just need to make sure you have the right paperwork to back it up.

However, some taxpayers are still randomly selected so you can’t shield yourself totally from being audited but you can limit your chances by adopting some of the tips.

2. Know If You Are A Likely Target

If you are in cash-based employment in a profession such as a physician, attorney or bookkeeper, you are more likely to be audited and need to be particularly careful about documenting all your deductions.

3. Incorporate If You’re Self-Employed

Filing Schedule C as a self-employed taxpayer often gives rise to an audit incentive. If you are self-employed, establishing your business as a Limited Liability Company (LLC) means you could be audited less than smaller businesses. Becoming a LLC often entitles you to further deductions.

Overall, small companies are some of the IRS’ preferred audit targets and recruiting someone to manage your returns can work to your advantage.

4. Include Explanations

If you believe your report carries the risk of an audit alarm, you can include supplementary documents to clarify the contradictions of previous years’ returns in fields such as changes in occupation, dependents, deduction numbers and profits.

For example, if your charitable contribution is significantly greater than in previous years, by providing clarification and copies of the canceled checks. The DIF program may still flag you, but a human IRS investigator will look through them to decide whether the expenses are worth auditing.

5. Know What Is Questioned

Two of the main IRS audit flags are bad debt, extensive costs, home office deductions, health expenditures and corporate transport, lodgings and personal expenses.

The value of accurate reporting such deductions cannot be overstated.

6. Avoid Filing Amendments To Your Return

If submitting a revised report, the initial report can still be checked, so try the utmost to submit it properly for the first time.

7. Know When To File

Most tax experts suggest the later you register, the less likely you are to be audited. Some go a step further and suggest that you can also submit amendments because most returns are chosen for audit by the current extension of October 15.

If you owe money, you are always required to pay by April 15 or risk fines. But if you’re not aware of the sum you’re supposed to repay even submitting a tiny payment, just $10, with your on-time return demonstrates good faith on your side and could reduce potential tax penalties.

Alternatively, if you anticipate a refund and do not expect audit issues, file as early as possible so that you can get your money faster.

8. Check Your Math

Double-check everything and check figures match that of the documents sent by employees since the program will compare them and flag any anomalies.

Pay particular attention to exemptions that are modified gross profit limits, such as medical cost exemptions. You will not be audited for a minor mistake.

9. Be Exact And Be Neat

Using precise figures instead of rounding off and work neatly so there are no confusions. Make sure your state tax returns complement your federal tax returns.

10. Leave Nothing Blank

The devil is in the details and for the IRS, the justification for an audit could literally be an empty space. Therefore, answer all the questions, even if it’s with a dash.

Regardless of the steps you take, there is no way to guarantee you will never be picked for an audit so it is vital to always keep your records well organized and up to date. If you have nothing to hide, you won’t have anything to worry about, especially with the paperwork to prove it.